tax return unemployment covid

State Information Data Exchange System SIDES. 170 ties the extension date for various statutes of limitations regarding the filing of a claim for refund or credit to the end of the PHE.

The Case For Forgiving Taxes On Pandemic Unemployment Aid

The IRS has identified 16.

. For more information please refer to the resources. COVID-19 is still active. You should receive a Form 1099-G showing total unemployment compensation paid to you in 2020.

The American Rescue Plan extended employment assistance starting in March 2021. The additional 600 per week that the Coronavirus Aid Relief and Economic Security Act provides for qualifying state unemployment insurance beneficiaries is considered taxable income and it adds up fast. COVID-19 Related Tax Information COVID-19 Teleworking Guidance Updated.

The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. Across the nation millions of Americans lost their jobs in the wake of the COVID-19 pandemic and as a result claimed unemployment benefits. Free Federal Tax Filing.

Non-resident Employees of the City of New York - Form 1127. It expands states ability to provide unemployment insurance for many workers impacted by the COVID-19 pandemic including for workers who are not ordinarily eligible for unemployment benefits. So keep in mind.

COVID Tax Tip -IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds. A key update in the bill which the house passed Wednesday is a provision that waives taxes on the first 10200 in unemployment insurance income for individuals who have 2020 adjusted gross. Helping Clients With Their Yearly Tax Preparation Needs For Over 20 Years.

Ad Premium Federal Tax Software. In addition to eliminating the unemployment tax break here are a few changes that may surprise you during your tax filing process. Stay up to date on vaccine information.

The Coronavirus Aid Relief and Economic Security CARES Act was signed into law on March 27. In addition the American Rescue Plan waives federal income taxes on the first 10200 of unemployment benefits received in 2020 by. NYC-200V Payment Voucher for Tax Returns and Extensions.

You are a part-year resident with any income during your resident period or you had New York source income during your nonresident period and your New York adjusted gross. Call NJPIES Call Center. If you move and dont receive a 1099G from your.

COVID-19 Related Tax Information COVID-19 Teleworking Guidance Updated 08032021. Congress has bolstered the Child Tax Credit for 2022. For example the extra 600 alone adds up to 9600 in income if you collect this additional benefit for a 16-week period.

E-File your IRS Tax Return Today Get Your Maximum Refund. Ad Providing Complete And Accurate Tax Preparations For Over 20 Years. All Extras are Included.

Military Request for Relief from Lien Sales. 2021 c103 specifically extended EO-170 until January 1 2022 unless EO-170. People who become unemployed for the first time are often shocked to learn that they must report their unemployment benefits more than 10200 on their 2020 tax return.

Power of Attorney POA-2. If you are a New York State part-year resident you must file Form IT-203 Nonresident and Part-Year Resident Income Tax Return if you meet any of the following conditions. Initially offering up to 2000 per qualifying child this years version sees an 80 bump to 3600 per child under the age of 6 3000 for a qualifying.

Repeals state and local income taxes on unemployment insurance benefits for the 2020 and 2021 tax years for. Governor Larry Hogan Issues Executive Order to Waive Charging of COVID-19 Unemployment Insurance Benefits to Employers. Unemployment benefits at tax time.

Dont report it on your federal tax return or the IRS will assume that you have received unemployment benefits. President Joe Biden signed the pandemic relief law in March. Update Return to Work Information or Report Job Refusals.

Michiganders Are Still Facing Steep Bills From An Unemployment Agency Error Experts Worry Their Tax Returns Could Be Seized Mlive Com

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2021 Unemployment Benefits Taxable On Federal Returns King5 Com

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

How Unemployment Can Affect Your Tax Return Jackson Hewitt

1099 G Tax Form Why It S Important

How To Claim Unemployment Benefits H R Block

Des Covid 19 Information For Individuals

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

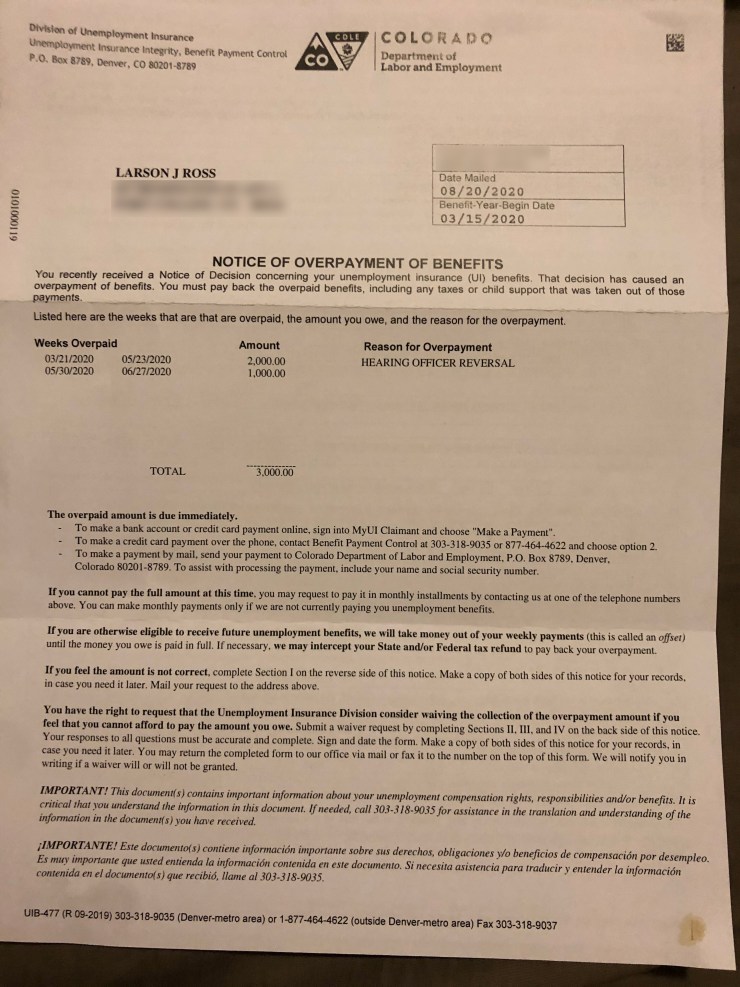

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals